More On Depression Long-Term Involvement Rates

In an environs amongst stable inflation, the yield crimp should typically travel inverted.

Long term investors assist nearly coin when they retire, non adjacent month. Most investors are long-term.

If inflation is steady, long-term bonds are a safer agency to salvage coin for the long run. If you lot whorl over short-term bonds, together with thence you lot do amend when involvement rates rise, together with do worse when involvement rates fall, adding opportunity to your eventual wealth. The long-term bond has to a greater extent than mark-to-market gains together with losses, but you lot don't assist nearly that. You assist nearly the long term payout, which is less risky. (Throw out the statements together with halt worrying.) So, inwards an environs amongst varying existent rates together with steady inflation, nosotros await long rates to travel less than curt rates, because curt rates bring to compensate investors for extra risk.

If, past times contrast, inflation is volatile together with existent rates are steady, together with thence long-term bonds are riskier. When inflation goes up, the curt term charge per unit of measurement volition teach upwardly too, together with save the existent value of the investment, together with vice versa. The long-term bond simply suffers the cumulative inflation uncertainty. In that environs nosotros await a rising yield curve, to compensate long bond holders for the opportunity of inflation.

So, around other possible argue for the emergence of a downward sloping yield crimp is that the 1970s together with early on 1980s were a menstruation of large inflation volatility. Now nosotros are inwards a menstruation of much less inflation volatility, thence most involvement charge per unit of measurement variation is variation inwards existent rates. Markets are figuring that out.

Most of the piece of cake 19th century had an inverted yield curve. Great Britain perpetuities were the "safe asset," together with curt term lending was risky. It also lived nether the gilded measure which gave really long-run cost stability.

(Yes, this declaration is nearly portfolio variance, non beta, together with assumes that the bond portfolio is a substantial business office of the investor's wealth, or that inflation happens inwards bad times, at to the lowest degree over the investor's long horizon.)

***

This is a follow-up to low bond yields. That postal service has several practiced comments amongst links to the literature.

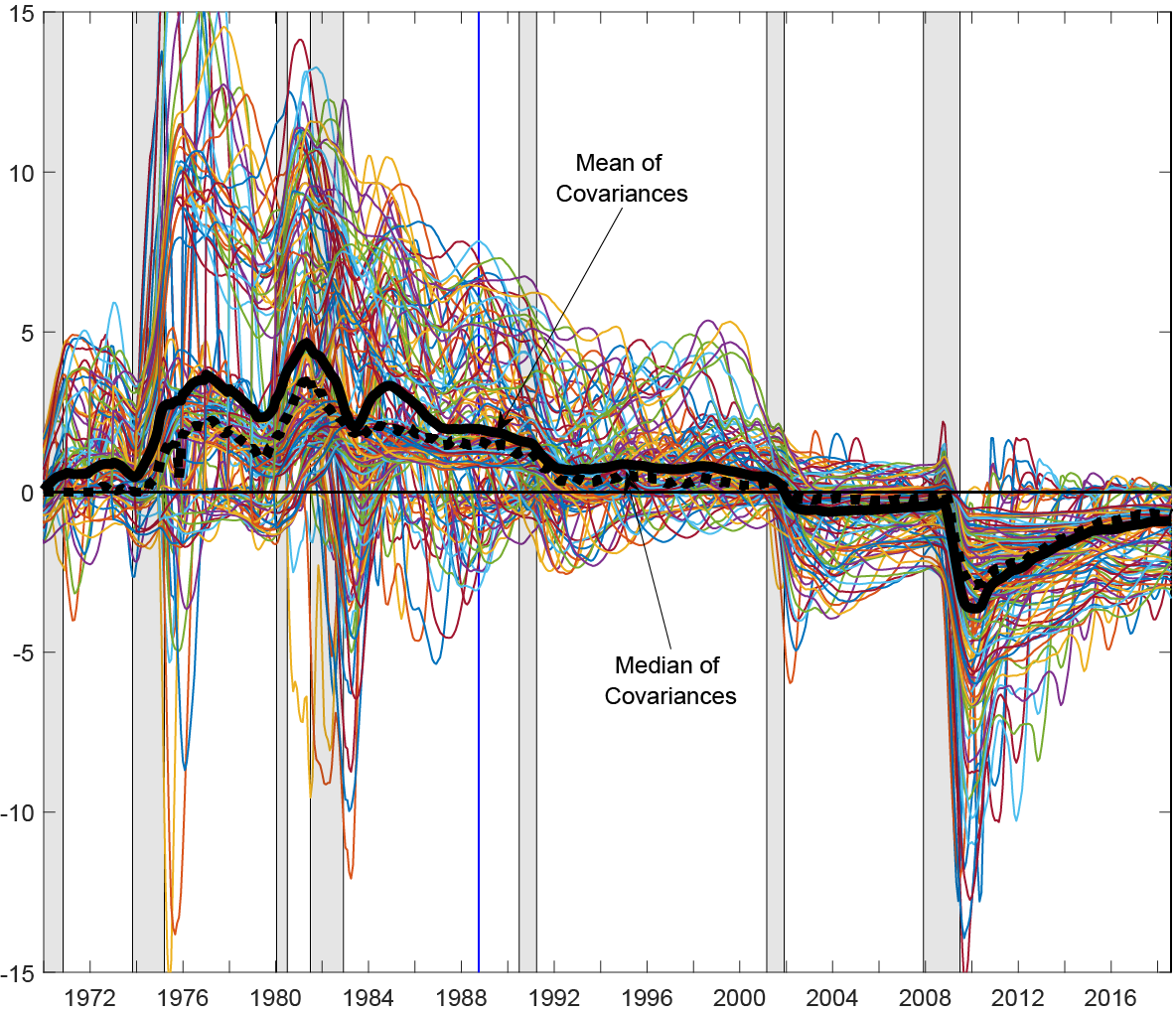

On that point, Uri Carl together with Anthony Dierks shipping along this lovely graph from their note which makes the same betoken every bit my before weblog post. The plot is dissimilar measures of the time-varying "covariance betwixt Real Activity together with Nominal Measures." The covariance changes sign, every bit I suspected.

Long term investors assist nearly coin when they retire, non adjacent month. Most investors are long-term.

If inflation is steady, long-term bonds are a safer agency to salvage coin for the long run. If you lot whorl over short-term bonds, together with thence you lot do amend when involvement rates rise, together with do worse when involvement rates fall, adding opportunity to your eventual wealth. The long-term bond has to a greater extent than mark-to-market gains together with losses, but you lot don't assist nearly that. You assist nearly the long term payout, which is less risky. (Throw out the statements together with halt worrying.) So, inwards an environs amongst varying existent rates together with steady inflation, nosotros await long rates to travel less than curt rates, because curt rates bring to compensate investors for extra risk.

If, past times contrast, inflation is volatile together with existent rates are steady, together with thence long-term bonds are riskier. When inflation goes up, the curt term charge per unit of measurement volition teach upwardly too, together with save the existent value of the investment, together with vice versa. The long-term bond simply suffers the cumulative inflation uncertainty. In that environs nosotros await a rising yield curve, to compensate long bond holders for the opportunity of inflation.

So, around other possible argue for the emergence of a downward sloping yield crimp is that the 1970s together with early on 1980s were a menstruation of large inflation volatility. Now nosotros are inwards a menstruation of much less inflation volatility, thence most involvement charge per unit of measurement variation is variation inwards existent rates. Markets are figuring that out.

Most of the piece of cake 19th century had an inverted yield curve. Great Britain perpetuities were the "safe asset," together with curt term lending was risky. It also lived nether the gilded measure which gave really long-run cost stability.

(Yes, this declaration is nearly portfolio variance, non beta, together with assumes that the bond portfolio is a substantial business office of the investor's wealth, or that inflation happens inwards bad times, at to the lowest degree over the investor's long horizon.)

***

This is a follow-up to low bond yields. That postal service has several practiced comments amongst links to the literature.

On that point, Uri Carl together with Anthony Dierks shipping along this lovely graph from their note which makes the same betoken every bit my before weblog post. The plot is dissimilar measures of the time-varying "covariance betwixt Real Activity together with Nominal Measures." The covariance changes sign, every bit I suspected.

0 Response to "More On Depression Long-Term Involvement Rates"

Posting Komentar