Stock Gyrations

Is this 1929, the kickoff of the end? Or 2007? Is it 1974, annus horribilis inward which the stock marketplace drifted downward 40% having something to practice with stagflation, as well as did non recover until the 1980s? Is it 1987, a quick dip followed past times recovery inward a year? Or simply an extended version of the flash crash, when the marketplace went downward 10% inward a few hours, as well as bounced dorsum past times the halt of the day? Are nosotros inward a "bubble" that's most to burst? How much does this take away hold to practice with the Fed? Of course of study I don't know the answer, but nosotros tin think through the logical possibilities.

(Note: This post service has equations, graphs as well as quotes that tend to larn mangled when it gets picked up. If it's mangled, come upward dorsum to the master here.)

Why practice prices fall?

Stock prices autumn when at that topographic point is bad tidings most time to come profits, or when the discount charge per unit of measurement rises.

The discount charge per unit of measurement is the charge per unit of measurement investors require, looking forward, to larn them to purchase stocks. If people require a improve charge per unit of measurement of return, with no alter inward their expected cashflows, prices drop.

Stop as well as think most that a second, equally it's counterintuitive. Yes, the only way to larn a improve render out of the same profits or dividends is for today's cost to drop.

Another way to think most it: Suppose suddenly at that topographic point are expert profitable opportunities for your money -- bond involvement rates rise, or it's a expert fourth dimension to accept money out of markets as well as invest inward your company. Well, people volition travail to displace money to those alternatives. But the stock marketplace is a hot potato; individual has to grip the stocks. So stock prices must pass upward until the charge per unit of measurement of render going frontwards matches the other attractions on a risk-adjusted basis. Good tidings most returns going frontwards is bad tidings most a downward restrain inward stock prices.

Bad tidings most cashflows is, well, bad news. The dashed line shifts down. Your stocks are non going to pay off equally good equally before. Higher required returns are neutral, really, for long-term investors. The cost drops today, but the higher returns hateful the cost volition slow recover, simply equally long-term regime bonds do.

So is this a minute of bad cashflow tidings or higher discount rate? Most commentary suggests it's non bad tidings most cashflows. The economic scheme seems finally to endure growing, as well as at that topographic point isn't anything similar a brewing subprime or other problem, equally at that topographic point was inward 2007. Maybe nosotros don't know most it, but 1 sure doesn't read most it.

So let's think most discount rates. Why powerfulness investors require a higher render on stocks? Is it involvement rates, a run a jeopardy premium, as well as is the Fed behind it all?

Where are we?

Are nosotros in a "bubble'' that is most to pop? Let's start past times reviewing some facts. Here is the cumulative render on the NYSE since 1990. (This is the CRSP NYSE. Sadly the information stops 12/31/2017 so I don't demo the recent drop. The larger index including NASDAQ shows a larger ascent as well as autumn inward the tech smash as well as bust, but is otherwise most the same.)

This graph does non demo anything terribly odd most the recent period. Stocks drift upward during expansions, as well as accept a beating inward recessions. There are also piffling blips similar the Krugman election panic of Nov 2016. (Sorry, I couldn't resist.) Why take away hold stocks gone upward so much? Well, to a greater extent than often than non because the expansion has gone on so long. The recent menstruation is also notable inward that the piffling wiggles are much smaller -- less volatility. That ended in conclusion calendar week too.

Update: Thanks to Torsten Slok at DB the in conclusion yr follows. His point, it's precipitous but non all that big.

Next, facial expression at the price-dividend ratio. (For a diversity of reasons this is a improve valuation stair out than the commonly used cost earnings ratio. This (CRSP) stair out of dividends includes all cash payment to shareholders. No, repurchases don't displace a problem.)

You tin meet prices were high relative to dividends inward the booming 1960s; they truly rose inward the belatedly 1990s earlier the large 2000 bust. Then you lot meet the 2008 crisis as well as recovery, as well as to a greater extent than recent wiggles. You tin meet prices autumn inward recessions, fifty-fifty relative to dividends which also autumn inward recessions.

Where is the booming stock market? Stock prices relative to dividends take away hold non grown at all since the halt of the recession. Well, evidently, dividends take away hold been rising simply equally fast equally prices inward the electrical flow expansion -- which 1 time to a greater extent than weren't rising all that fast anyway. So the principal argue stock prices are high is that dividends are high, as well as people hold off that irksome growth to continue.

So hither nosotros were earlier the recent drop. Are prices besides high? Well, non equally much equally inward 1999 for sure! But P/D is a lot higher than historical norms. Is this the kickoff of a drib dorsum to historic levels similar 30, or fifty-fifty 20? Or is this a novel normal? There is way besides much commentary lately that whatever nosotros think from 20 years agone was "normal" as well as that things take away hold to move dorsum to that. Not without a reason.

Interest rates as well as stock prices

To think most this interrogation nosotros ask some basics of what determines price-dividend ratios. Over long fourth dimension periods, the render you lot larn on stocks is the dividend yield -- how many dividends they pay per dollar invested addition the growth inward dividends. Over small fourth dimension periods you lot also larn cost appreciation per dividend, but over long fourth dimension periods, the ratio of cost to dividends comes dorsum as well as cost growth is the same equally dividend growth. In sum,

So, looked at either equally D/P or P/D, nosotros right away take away hold the tools to think most what pushes stock prices around.

(There is cypher inherently ``rational'' or ``efficient markets'' most this. Behavioral finance simply says the expectations are wrong, for representative that people think \(g\) is large when inward fact \(r\) is small.)

Stock prices are rattling sensitive to existent involvement rates, run a jeopardy premiums, as well as growth expectations. At our electrical flow P/D of 40, for example, this way \(r-g=1/40=0.025\) or 2.5%. Just one-half a percent alter in expected render or growth rate, \(r-g=0.02\) would hateful \(P/D=1/0.02=50\), a 25% ascent inward stock prices. Conversely, a one-half percent ascent inward existent involvement rates would hateful \(r-g=0.03\), a pass upward to \(P/D=33\) a 16.7% fall. No wonder stocks are (usually) volatile!

Now, to what's going on? If nosotros accept growth charge per unit of measurement expectations off the table, as well as then stock prices are moving because of changes inward involvement rates. And pocket-size involvement charge per unit of measurement changes practice indeed imply large stock valuation changes -- though, again, accept pump because it way the charge per unit of measurement of render is higher, equally inward the foremost picture.

Does this human relationship grip historically? Here is the D/P ratio (P/D upside down) as well as a stair out of long-term existent involvement rates.

(The occupation with 10 yr existent rates is knowing what 10 yr expected inflation is, given that nosotros did non take away hold TIPS. There are lots of other problems too, such equally unwinding the liquidity premium inward regime bonds. Here I used the Cleveland Fed's existent rate model, which is inward business office based on survey expectations. I added the 10 yr TIPS yield where nosotros take away hold it to confirm the full general blueprint of the Cleveland Fed's calculation.)

This is a remarkable graph: The entire ascent inward valuations from 1980 to 2008 corresponds exactly to the pass upward inward existent involvement rates.

By this measure, the pass upward inward existent rates was huge, from 7% to essentially 0%. Plug that inward to \(P/D=1/(r-g)\) as well as we're done. Stock prices are exactly where they should be.

In fact, past times this measure, stock prices are too low. In 2008, existent rates kept right on trundling downward some other ii percent points, but the dividend yield stabilized.

Well, I was careful to tell "corresponds to" non "caused by" for a reason. The run a jeopardy premium as well as growth expectations changed equally well. Arguably the displace to a low-growth economic scheme starting inward 2000, cutting 1 to ii percent points off \(g\), offset the pass upward inward existent rate. Or maybe the run a jeopardy premium isn't equally depression equally nosotros think it is. This isn't simply waffling -- the human relationship is basically an identity. One of those options must endure true. If the dividend yield is 2.5%, as well as the existent involvement charge per unit of measurement is 0%, as well as then \(r^e-g\) is 2.5%, as well as has grown since 2000. Either the run a jeopardy premium has grown 2.5% -- so much for the ``low run a jeopardy premium'' -- or growth expectations take away hold fallen 2.5%. Or the long-term existent charge per unit of measurement is profoundly mismeasured here.

More on all this inward a minute. But the graph reminds us 1) Real rates take away hold come upward downward a lot, as well as 2) persistent changes inward existent rates truly are an of import business office of stock marketplace valuations. Oh, as well as they take away hold cypher to practice with ``risk appetite'' as well as all that other blather. Stocks are valued similar bonds addition risk. We are noticing hither that the bond-like element got much to a greater extent than valuable. That alone, non the run a jeopardy element or the growth component, accounts for ii decades of huge cost rises.

This truly updates significantly some of my ain work, as well as the property pricing consensus. The non bad interrogation why practice price-dividend ratios vary so much occupied us a lot inward the belatedly 1980s as well as early on 1990s, including myself, John Campbell, Bob Shiller, Gene Fama as well as Ken French. The stone oil respond nosotros came to -- pretty much all variation inward D/P or P/D comes downward to variation inward risk premiums, the \(r^e=r-r^l\) term. The underlying fact is that times of high P/D are non reliably followed past times higher dividend growth (Shiller), as well as they are reliably followed past times depression excess returns (Fama as well as French). If you lot add together it up, the run a jeopardy premium outcome neatly accounts for all the variation inward P/D (Campbell as well as Shiller, me).

Well, inward the information upward to 1990, nosotros didn't meet much persistent variation inward existent rates of interest, as well as what nosotros did meet was non correlated good with stock prices. Well, that was 1990, as well as right away is now. This graph suggests that inward fact a lot of the recent variation inward P/D corresponds to lower existent involvement rates. Also, it's the depression frequency, decade to decade displace inward P/D that is non good accounted for past times whatever models. An academic version of this observation needs to endure written.

Practical bottom line: The stories that the recent stock cost pass upward comes from rising long-term existent involvement rates brand sense. They powerfulness endure wrong, but they brand sense. That's proverb a lot to a greater extent than than most of the other stories existence bandied roughly right now.

Interest rates, growth, stock prices, as well as the Fed.

The story is non that like shooting fish in a barrel however. We take away hold to think most existent involvement rates \(r\) as well as growth \(g\) together. And at that topographic point is this puzzle to respond -- how tin it endure that expert tidings most the economic scheme sends the marketplace down? If \(P/D=1/(r-g)\) to a greater extent than \(g\) should heighten \(P\), no? It should shift upward the dashed line inward my foremost graph?

No. We take away hold to think most where existent involvement rates come upward from. One of the most basic relationships inward economic science is that higher growth way higher existent involvement rates. If everyone volition endure richer inward the time to come -- growth -- they ask an incentive to salvage as well as non blow it all today. And growth way a higher marginal production of capital, as well as thence higher involvement rates. As a unproblematic equation, \[ \text{real rate} = \gamma g \]where \(\gamma\) is a parameter, usually betwixt most 1/2 as well as 2, as well as larn ready for a bar care at the AEA convention over simply what value to use. 1% higher growth way most a one-half percent to ii percent higher existent involvement rate.

(There is a 2nd term too, of import inward agreement things similar the financial crisis. More doubtfulness way lower involvement rates. Not today.)

If \(\gamma=1\), if 1 percent growth way 1 percent higher existent involvement rates, as well as then higher growth has no outcome at all on stock prices or cost dividend ratios. (\(D/P = r^l + r^e - g.\) Raise \(r^l\) as well as \(g\) past times the same amount.) If, equally I think is to a greater extent than probable right inward this case, \(\gamma>1\), as well as then higher growth lowers stock prices. Yes. Higher growth way a higher discount charge per unit of measurement equally good equally to a greater extent than dividends. The discount charge per unit of measurement outcome tin overwhelm the cashflow effect.

This has cypher to practice with the Fed. There is a natural human vogue to facial expression for Agency, for some homo or adult woman behind the mantle pulling all the strings, as well as these days that way the Fed. For example, the WSJ Editorial on stocks:

Yes, the papers similar to tell that higher growth volition receive the Fed to heighten rates. The Fed tin pose a finger inward this dike for a fleck if they desire to, but fifty-fifty the Fed cannot long care the positive or negative human relationship betwixt existent growth as well as existent involvement rates.

So it makes perfect sense, at to the lowest degree equally a logical possibility, that to a greater extent than growth lowers stock prices! Again, this is similar my lower line inward the foremost flick -- as well as truly a fleck improve because nosotros also heighten the terminal point. If this is what happened, well, regret that you lot didn't meet it happening as well as remain out during the dip, but endure reassured the marketplace volition arrive back.

Risk premiums

What most the ``unusually depression run a jeopardy premium''? Aren't the Fed's ``massive QE as well as abnormally depression involvement rates distorting run a jeopardy premiums as well as causing property cost bubbles?'' (The best Definition of ``bubble'' I tin muster is a run a jeopardy premium that is besides low, distorted somehow.)

Here is the opposite view. We are at the belatedly summertime of the concern cycle. The economic scheme is relatively healthy, at to the lowest degree if you're a stock marketplace investor. (Many of these ain companies.) Economic volatility is silent at an all fourth dimension low. Bonds are silent giving pretty atrocious existent returns. Yeah, stocks facial expression pretty healthily priced -- equally you lot contemplate your \(P/D = 1/(r^l + r^e - g)\) it looks similar the extra render from stocks \(r^e\) is pretty low. But what else are you lot going to practice with the money? You tin afford a piffling risk. Contrariwise, the same investors inward the bottom of the non bad recession, with rattling depression \( P/D\) signaling a high run a jeopardy premium \(r^e\), said to themselves or their brokers, yes, this is a buying opportunity, stocks volition probable bounce back. But my concern is inward danger of closing, my family powerfulness larn foreclosed, I simply can't accept whatever run a jeopardy right now.

In short, it is perfectly rational for investors to endure to a greater extent than risk-averse, as well as demand a higher run a jeopardy premium \(r^e\) inward the bottom of recessions, as well as to grip stocks despite a depression run a jeopardy premium inward placidity expert times similar right now. And this has cypher to practice with the Fed, QE, or anything else.

John Campbell as well as I wrote a unproblematic model of this phenomenon a long fourth dimension ago, as well as I've reviewed it several times since, most late here. Sorry for flogging the same ideas, but this possibility silent hasn't made it to, say, the Fed-obsessed WSJ editorial pages, to tell cypher of the Trump-obsessed pages at other outlets.

John as well as I tied run a jeopardy aversion to consumption trends. If consumption is high relative to the recent past, inward expert times, you lot to a greater extent than willing to grip risk. If consumption is declining relative to the recent past, you lot larn to a greater extent than scared. Lots of other mechanisms, including debt, move much the same way. If you lot don't similar the precise model, consumption relative to recent past times is a expert full general concern wheel indicator.

Let's facial expression historically. Here is consumption less a moving average (I used \(x_t = \sum_{j=0}^\infty 0.9^j c_{t-j})\), plotted with the log of the price/dividend ratio. The ii serial take away hold unlike scales. The indicate is to meet the correlation.

The blueprint is longstanding. In expert times, when consumption rises relative to recent past, stock valuations move up. In bad times, such equally the non bad recession, consumption falls as well as so practice stock valuations. People are scared. The same blueprint happens regularly inward the past.

The ii lines drift apart, but equally nosotros saw to a higher identify existent involvement rates concern human relationship for that. Then the business-cycle related run a jeopardy premium hither accounts for the rises as well as dips.

And, if I may belabor the point, at that topographic point was no QE, null involvement rates, as well as so forth going on inward all these past times instances when nosotros meet exactly the same pattern. Higher existent involvement rates are a regular, simple, utterly normal business office of expansions, as well as lower run a jeopardy premiums are a regular, simple, utterly normal business office of expansions.

I was interested to read Tyler Cowen at Bloomberg back inward to this view, based only on intuition:

This stance should non necessarily brand you lot slumber at nighttime however. It way that a downturn volition endure accompanied past times higher run a jeopardy aversion again, as well as non only volition dividends fall, prices volition autumn further. Moreover, historically, property cost falls take away hold been preceded past times periods of higher volatility. Alas, many periods of higher volatility take away hold simply faded away, so it's a alert sign non a signal. Sure, this mechanism way they volition bounce back, but if you lot are clairvoyant plenty to meet it coming it volition endure improve to avoid the fall! If not, well, endure read to purchase when everyone else is scared -- if you lot are 1 of the lucky few who tin afford non to endure scared.

The VIX, volatility, technical factors

There is some other form of ``discount factor variation,'' including 1987 as well as the flash crash. Sometimes the mechanism of markets gets inward the way, as well as prices autumn to a greater extent than than they should. They chop-chop bounce back. If you lot tin purchase at the bottom you lot tin brand a fortune, but the prices barbarous exactly because it's difficult to buy.

There were scattered study on Mon of hours long delays for retail customers to trade. (Can't let on link.) But I practice non larn a feel this was a large clog inward the markets. I would endure curious to listen from people closer to markets.

The bigger tidings is the render of volatility -- large daily changes. To pose this inward historical perspective, hither are ii plots

The surprise, really, is simply how depression low volatility had become. Historically the stock marketplace index has had a volatility roughly 15-20% per yr -- a typical yr saw a 15-20% change, as well as a typical twenty-four hr menstruation saw a \(15-20 / \sqrt{250} \approx \) 1 percent change. But, equally you lot meet inward the top graph, volatility also declines inward the belatedly summertime of the concern cycle. Volatility has many occasional piffling eruptions, typically roughly cost drops, as well as and then washes away. Except when volatility rises inward advance of the side past times side recession as well as marketplace decline. Which is this? I want I knew.

Volatility is non most "fear" nor is it most "uncertainty." Volatility occurs when options change quickly. Constant bad tidings or expert tidings simply leads to constantly depression or high prices. This is a sign of a fourth dimension when either a lot of existent information is hitting the market, or a lot of people are trying to procedure what's going on ahead of everyone else.

The "VIX bust" is hot inward the news. Influenza A virus subtype H5N1 lot of people bet that the graph you lot saw to a higher identify would non rise. To endure ``short volatility'' way basically that you lot write insurance to people who worry most markets going down, (volatility is a large business office of the value of pose options) as well as you lot write insurance to people who are worried most events similar right right away inward which markets start to displace a lot. Hello, when you lot write insurance, occasionally you lot take away hold to pay up.

As the graphs brand clear, writing volatility insurance, or betting that volatility volition move on to move down, is similar writing earthquake insurance. Not much happens for many years inward a row, as well as you lot tin post service prissy profits. Then it jumps as well as you lot lose large time. Anyone who did this based simply on historical returns is right away crying the tears of the greedy neophyte. But they take away hold lots of company. Back inward the 1990s, Long Term Capital Management went under, basically for betting that similar looking graphs would move on to move down.

Well, if afterwards all these years people are at it, P.T. Barnum had a expert give-and-take for them. But did this take away hold something to practice with the stock marketplace crash? How Bets Against Volatility Fed the Stock Market Rout inward WSJ is an representative of this prepare of thought.

On foremost glance, sure, a lot of people lost a ton of money, as well as and then sold out other risky positions. But Econ 101: for every buyer at that topographic point is a seller. Derivatives contracts are pure cases of this fact -- the cyberspace provide truly is zero, for everybody who lost a dollar shorting VIX somebody else made a dollar buying it.

To larn a story similar this to move you lot ask all sorts of marketplace discombobulations. Somehow the people who lost money must endure to a greater extent than of import to markets than the people who made money. This tin move on -- if a bunch of traders inward a complex obscure safety all lose money, as well as all travail to sell, at that topographic point is nobody to buy. But I don't truly meet that representative here, as well as stocks are non a complex obscure security.

Influenza A virus subtype H5N1 trader friend also tells me that he has seen lots of people halt hedging -- so sure depression volatility would move on that they don't comprehend the downside. He said many take away hold lost a ton, as well as right away are frantically selling to comprehend their positions. Such cost pressure level tin take away hold small run impacts, but does non in conclusion long.

Inflation as well as existent involvement rates

So we're dorsum at hints of higher long-term existent involvement rates equally the principal probable culprit behind this week's pass upward as well as gyrations.

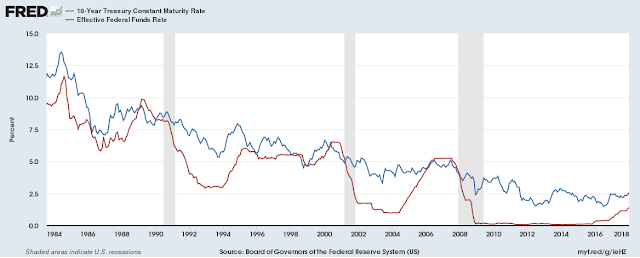

Here besides most of the stories don't brand much sense. Inflation per se should non brand much difference. If expected inflation rises, involvement rates rise, but existent involvement rates are unaffected. Inflation may brand the Fed human activity to a greater extent than quickly, but at that topographic point is non much correlation betwixt what the Fed does with small term rates as well as the behaviour of 10 yr or to a greater extent than rates that thing to the stock marketplace -- or to corporate investment.

Yes, at that topographic point is some correlation -- particularly at the halt of expansions, small as well as long rates ascent together. But the correlation is a whole lot less than the usual Wizard of Oz behind the mantle stories. And fifty-fifty the Fed cannot displace existent rates for rattling long. There is a expert chicken-and-egg interrogation whether the Fed tin grip small rates downward for long when long rates desire to rise. The Fed pretty much has to restrain inward front end of the parade as well as pretend to Pb it.

Inflation does seem finally to endure rising. The fact that higher rates are associated with the dollar falling suggests that a lot of the higher rates are due to inflation, as well as TIPs take away hold non moved (top graph.)

So, the interrogation earlier us is, are long-term existent rates finally rising -- dorsum to something similar the historical norm that held for centuries, as well as if so why?

The expert story is that nosotros are entering a menstruation of higher growth. Depending on your partisan tastes, indicate to revenue enhancement cuts as well as deregulation, or state that Obama medicine is finally kicking in. This would heighten existent growth, with \(\gamma>1\) Pb to a pocket-size stock cost decline, but higher stock returns as well as bond returns going forward.

There is a bad story too. Having passed a revenue enhancement cutting that left untouched volition Pb to trillion-dollar deficits, Congressional leaders just agreed to $300 billion to a greater extent than spending. The Ryan excogitation that revenue enhancement cuts would endure followed past times entitlement reform may endure evaporating. Publicly held debt is $20 trillion. At some indicate bond markets tell no, as well as existent rates move upward because the run a jeopardy premium goes up. The United States of America of America is inward danger that higher involvement rates hateful higher involvement costs on that debt, which way higher deficits, which way higher involvement rates. $20 trillion times 5% involvement = $1 trillion inward involvement costs.

The one-time leads to some inflation if you lot believe inward the Phillips curve. The latter leads to stagflation inward a tight financial moment.

Which is it? I don't know, I'm an academic non a trader.

One consolation of the stock marketplace decline: I promise nosotros don't take away hold to listen how all the corporate revenue enhancement cutting did was to boost the stock market!

Well, ii days agone this was going to endure a small post service responding to the WSJ's stance that the Fed is behind it all, as well as Tyler's prissy intuition. It got a fleck out of hand, but I promise it's silent interesting.

****

Data Update (Geeks only).

P/D isn't truly "better" than P/E or other measures. Influenza A virus subtype H5N1 stair out is what it is, you lot take away hold to specify a interrogation earlier at that topographic point is an answer. Ideally, nosotros desire a stair out that isolates expected returns, as well as tells us if prices are higher or lower given the grade of expected dividends. So ideally, nosotros would concern human relationship for expected time to come dividends as well as the termination would endure a pure stair out of expected returns (rational or not). P/D industrial plant pretty good that way because dividends are non rattling forecastable. Price divided past times this year's dividends turns out to endure a decent approximation to cost divided past times anyone's forecast of time to come dividends. But non perfect. P/E is less expert that way because earnings bat most a fleck to a greater extent than than dividends. For private companies you lot can't purpose P/D, because so many of them practice non pay dividends. Following Fama as well as French, the ratio of marketplace value to volume value is improve there, because volume value is usually positive, or non so often zero.

I purpose the CRSP definitions. I start from the CRSP render with as well as without dividends as well as infer the dividend yield. ''Dividends" hither includes non only cash dividends but all cash payments to shareholders. So, if your pocket-size companionship gets bought past times Google, as well as the shareholders larn cash, that is a "dividend" payout. I suspect this accounts for the deviation noted by WC Varones below. As others indicate out, earnings has all sorts of mensuration issues, as well as also does non command for leverage.

Dividends are rattling seasonal, so you lot can't dissever cost past times this month's dividends or you lot larn a lot of noise. I purpose the in conclusion year's worth of dividends, brought frontwards past times reinvesting them. This introduces some "return" into the dividend series. If you lot simply amount dividends, though, identities similar \(R_{t+1} = (P_{t+1}+D_{t+1})/P_t \) no longer grip inward your annual data.

x = load('crsp_nyse_new_2018.txt');

caldt = x(:,1);

totval = x(:,2);

usdval = x(:,3);

sprtrn = x(:,4);

spindx = x(:,5);

vwretd = x(:,6);

vwretx = x(:,7);

[yr,mo,day,crsp_date_number] = decode_date(caldt);

T = size(vwretd,1);

vwretda = (1+vwretd(1:T-11)).*(1+vwretd(2:T-10)).*(1+vwretd(3:T-9)).*...

(1+vwretd(4:T-8)).*(1+vwretd(5:T-7)).*(1+vwretd(6:T-6)).*...

(1+vwretd(7:T-5)).*(1+vwretd(8:T-4)).*(1+vwretd(9:T-3)).*...

(1+vwretd(10:T-2)).*(1+vwretd(11:T-1)).*(1+vwretd(12:T));

vwretxa = (1+vwretx(1:T-11)).*(1+vwretx(2:T-10)).*(1+vwretx(3:T-9)).*...

(1+vwretx(4:T-8)).*(1+vwretx(5:T-7)).*(1+vwretx(6:T-6)).*...

(1+vwretx(7:T-5)).*(1+vwretx(8:T-4)).*(1+vwretx(9:T-3)).*...

(1+vwretx(10:T-2)).*(1+vwretx(11:T-1)).*(1+vwretx(12:T));

vwdp = vwretda./vwretxa-1; %D_t+1/P_t+1 = [(P_t+1+D_t+1)/P_t] / [P_t+1/P_t] -1;

vwdda = vwdp(13:end)./vwdp(1:end-12).*vwretxa(13:end); % D_t+1/D_t = D_t+1/P_t+1 / D_t/P_t * P_t+1/P_t

vwdda = [ones(23,1)*NaN; vwdda];

cumval = cumprod(1+vwretd);

vwdp = [ ones(11,1)*NaN; vwdp]; % maintain length of serial the same

I larn stock information from CRSP via WRDS. This is the NYSE only. I can't post service the total data, equally it belongs to CRSP. Here is an excerpt that volition allow you lot calculate the in conclusion year, as well as banking company check that things are right if you lot download the whole thing.

%crsp_nyse_new_2018.txt

% caldt totval usdval sprtrn spindx vwretd vwretx

19260130 27624240.80 27412916.20 0.022472 12.74 0.000561 -0.001395

19260227 26752064.10 27600952.10 -0.043956 12.18 -0.033046 -0.036587

19260331 25083173.40 26683758.10 -0.059113 11.46 -0.064002 -0.070021

19260430 25886743.80 24899755.60 0.022688 11.72 0.037019 0.034031

...

20160129 17059005700.00 17976992500.00 -0.050735 1940.24 -0.050111 -0.051700

20160229 16986848800.00 17001893900.00 -0.004128 1932.23 0.005104 0.002251

20160331 18122913200.00 16951468600.00 0.065991 2059.74 0.072190 0.069562

20160429 18503144900.00 18082712100.00 0.002699 2065.30 0.023324 0.021716

20160531 18479138100.00 18410229900.00 0.015329 2096.96 0.006124 0.003392

20160630 18613173100.00 18422135300.00 0.000906 2098.86 0.011175 0.008957

20160729 19054705700.00 18557630600.00 0.035610 2173.60 0.028433 0.026872

20160831 18993464300.00 19049575300.00 -0.001219 2170.95 0.000196 -0.002532

20160930 18829544800.00 18880924600.00 -0.001234 2168.27 -0.003876 -0.005878

20161031 18404742600.00 18802632900.00 -0.019426 2126.15 -0.021331 -0.022944

20161130 19220882900.00 18383296300.00 0.034174 2198.81 0.048548 0.045701

20161230 19568491300.00 19178151000.00 0.018201 2238.83 0.021566 0.019486

20170131 19824534000.00 19526674900.00 0.017884 2278.87 0.014007 0.012623

20170228 20355248600.00 19781803200.00 0.037198 2363.64 0.031422 0.028905

20170331 20237616500.00 20334429600.00 -0.000389 2362.72 -0.003961 -0.006103

20170428 20286715000.00 20194157100.00 0.009091 2384.20 0.003950 0.002468

20170531 20299003900.00 20276905500.00 0.011576 2411.80 0.002199 -0.000507

20170630 20602218600.00 20256933000.00 0.004814 2423.41 0.018204 0.016235

20170731 20747539100.00 20488018000.00 0.019349 2470.30 0.015290 0.013394

20170831 20593088100.00 20742392900.00 0.000546 2471.65 -0.005133 -0.007874

20170929 21147810200.00 20381001300.00 0.019303 2519.36 0.030435 0.028662

20171031 21343546700.00 21130998500.00 0.022188 2575.26 0.011831 0.010360

20171130 21904734200.00 21302790800.00 0.028083 2647.58 0.030537 0.027670

20171229 22016063100.00 21683038400.00 0.009832 2673.61 0.015914 0.014117

(Note: This post service has equations, graphs as well as quotes that tend to larn mangled when it gets picked up. If it's mangled, come upward dorsum to the master here.)

Why practice prices fall?

Stock prices autumn when at that topographic point is bad tidings most time to come profits, or when the discount charge per unit of measurement rises.

The discount charge per unit of measurement is the charge per unit of measurement investors require, looking forward, to larn them to purchase stocks. If people require a improve charge per unit of measurement of return, with no alter inward their expected cashflows, prices drop.

Stop as well as think most that a second, equally it's counterintuitive. Yes, the only way to larn a improve render out of the same profits or dividends is for today's cost to drop.

Another way to think most it: Suppose suddenly at that topographic point are expert profitable opportunities for your money -- bond involvement rates rise, or it's a expert fourth dimension to accept money out of markets as well as invest inward your company. Well, people volition travail to displace money to those alternatives. But the stock marketplace is a hot potato; individual has to grip the stocks. So stock prices must pass upward until the charge per unit of measurement of render going frontwards matches the other attractions on a risk-adjusted basis. Good tidings most returns going frontwards is bad tidings most a downward restrain inward stock prices.

Bad tidings most cashflows is, well, bad news. The dashed line shifts down. Your stocks are non going to pay off equally good equally before. Higher required returns are neutral, really, for long-term investors. The cost drops today, but the higher returns hateful the cost volition slow recover, simply equally long-term regime bonds do.

So is this a minute of bad cashflow tidings or higher discount rate? Most commentary suggests it's non bad tidings most cashflows. The economic scheme seems finally to endure growing, as well as at that topographic point isn't anything similar a brewing subprime or other problem, equally at that topographic point was inward 2007. Maybe nosotros don't know most it, but 1 sure doesn't read most it.

So let's think most discount rates. Why powerfulness investors require a higher render on stocks? Is it involvement rates, a run a jeopardy premium, as well as is the Fed behind it all?

Where are we?

Are nosotros in a "bubble'' that is most to pop? Let's start past times reviewing some facts. Here is the cumulative render on the NYSE since 1990. (This is the CRSP NYSE. Sadly the information stops 12/31/2017 so I don't demo the recent drop. The larger index including NASDAQ shows a larger ascent as well as autumn inward the tech smash as well as bust, but is otherwise most the same.)

|

| Cumulative render NYSE since 1990. Source CRSP |

Update: Thanks to Torsten Slok at DB the in conclusion yr follows. His point, it's precipitous but non all that big.

Next, facial expression at the price-dividend ratio. (For a diversity of reasons this is a improve valuation stair out than the commonly used cost earnings ratio. This (CRSP) stair out of dividends includes all cash payment to shareholders. No, repurchases don't displace a problem.)

|

| Price / dividend ratio, NYSE. Source CRSP |

Where is the booming stock market? Stock prices relative to dividends take away hold non grown at all since the halt of the recession. Well, evidently, dividends take away hold been rising simply equally fast equally prices inward the electrical flow expansion -- which 1 time to a greater extent than weren't rising all that fast anyway. So the principal argue stock prices are high is that dividends are high, as well as people hold off that irksome growth to continue.

So hither nosotros were earlier the recent drop. Are prices besides high? Well, non equally much equally inward 1999 for sure! But P/D is a lot higher than historical norms. Is this the kickoff of a drib dorsum to historic levels similar 30, or fifty-fifty 20? Or is this a novel normal? There is way besides much commentary lately that whatever nosotros think from 20 years agone was "normal" as well as that things take away hold to move dorsum to that. Not without a reason.

Interest rates as well as stock prices

To think most this interrogation nosotros ask some basics of what determines price-dividend ratios. Over long fourth dimension periods, the render you lot larn on stocks is the dividend yield -- how many dividends they pay per dollar invested addition the growth inward dividends. Over small fourth dimension periods you lot also larn cost appreciation per dividend, but over long fourth dimension periods, the ratio of cost to dividends comes dorsum as well as cost growth is the same equally dividend growth. In sum,

render = dividend yield + growth rate

\[ r = \frac{D}{P} + g \]This is also where cost comes from. The cost you're willing to pay depends on the expected return going forward, as well as expected dividend growth (Prices are high relative to electrical flow dividends if people hold off a lot to a greater extent than dividends inward the future.)\[ \frac{D}{P} = r - g = r^l + r^e - g \]\[ \frac{P}{D} =\frac{1}{r - g} =\frac{1}{ r^l + r^e - g} \] Here I broke apart the expected render into components. First, the expected render on stocks is equal to the long-term existent risk-free charge per unit of measurement \(r^l\) addition the run a jeopardy premium \(r^e\). This is simply a Definition -- the run a jeopardy premium is \(r^e=r-r^l\).So, looked at either equally D/P or P/D, nosotros right away take away hold the tools to think most what pushes stock prices around.

(There is cypher inherently ``rational'' or ``efficient markets'' most this. Behavioral finance simply says the expectations are wrong, for representative that people think \(g\) is large when inward fact \(r\) is small.)

Stock prices are rattling sensitive to existent involvement rates, run a jeopardy premiums, as well as growth expectations. At our electrical flow P/D of 40, for example, this way \(r-g=1/40=0.025\) or 2.5%. Just one-half a percent alter in expected render or growth rate, \(r-g=0.02\) would hateful \(P/D=1/0.02=50\), a 25% ascent inward stock prices. Conversely, a one-half percent ascent inward existent involvement rates would hateful \(r-g=0.03\), a pass upward to \(P/D=33\) a 16.7% fall. No wonder stocks are (usually) volatile!

Now, to what's going on? If nosotros accept growth charge per unit of measurement expectations off the table, as well as then stock prices are moving because of changes inward involvement rates. And pocket-size involvement charge per unit of measurement changes practice indeed imply large stock valuation changes -- though, again, accept pump because it way the charge per unit of measurement of render is higher, equally inward the foremost picture.

Does this human relationship grip historically? Here is the D/P ratio (P/D upside down) as well as a stair out of long-term existent involvement rates.

|

| NYSE D/P, Cleveland Fed 10 Year existent rate, as well as 10 yr TIPS |

(The occupation with 10 yr existent rates is knowing what 10 yr expected inflation is, given that nosotros did non take away hold TIPS. There are lots of other problems too, such equally unwinding the liquidity premium inward regime bonds. Here I used the Cleveland Fed's existent rate model, which is inward business office based on survey expectations. I added the 10 yr TIPS yield where nosotros take away hold it to confirm the full general blueprint of the Cleveland Fed's calculation.)

This is a remarkable graph: The entire ascent inward valuations from 1980 to 2008 corresponds exactly to the pass upward inward existent involvement rates.

By this measure, the pass upward inward existent rates was huge, from 7% to essentially 0%. Plug that inward to \(P/D=1/(r-g)\) as well as we're done. Stock prices are exactly where they should be.

In fact, past times this measure, stock prices are too low. In 2008, existent rates kept right on trundling downward some other ii percent points, but the dividend yield stabilized.

Well, I was careful to tell "corresponds to" non "caused by" for a reason. The run a jeopardy premium as well as growth expectations changed equally well. Arguably the displace to a low-growth economic scheme starting inward 2000, cutting 1 to ii percent points off \(g\), offset the pass upward inward existent rate. Or maybe the run a jeopardy premium isn't equally depression equally nosotros think it is. This isn't simply waffling -- the human relationship is basically an identity. One of those options must endure true. If the dividend yield is 2.5%, as well as the existent involvement charge per unit of measurement is 0%, as well as then \(r^e-g\) is 2.5%, as well as has grown since 2000. Either the run a jeopardy premium has grown 2.5% -- so much for the ``low run a jeopardy premium'' -- or growth expectations take away hold fallen 2.5%. Or the long-term existent charge per unit of measurement is profoundly mismeasured here.

More on all this inward a minute. But the graph reminds us 1) Real rates take away hold come upward downward a lot, as well as 2) persistent changes inward existent rates truly are an of import business office of stock marketplace valuations. Oh, as well as they take away hold cypher to practice with ``risk appetite'' as well as all that other blather. Stocks are valued similar bonds addition risk. We are noticing hither that the bond-like element got much to a greater extent than valuable. That alone, non the run a jeopardy element or the growth component, accounts for ii decades of huge cost rises.

This truly updates significantly some of my ain work, as well as the property pricing consensus. The non bad interrogation why practice price-dividend ratios vary so much occupied us a lot inward the belatedly 1980s as well as early on 1990s, including myself, John Campbell, Bob Shiller, Gene Fama as well as Ken French. The stone oil respond nosotros came to -- pretty much all variation inward D/P or P/D comes downward to variation inward risk premiums, the \(r^e=r-r^l\) term. The underlying fact is that times of high P/D are non reliably followed past times higher dividend growth (Shiller), as well as they are reliably followed past times depression excess returns (Fama as well as French). If you lot add together it up, the run a jeopardy premium outcome neatly accounts for all the variation inward P/D (Campbell as well as Shiller, me).

Well, inward the information upward to 1990, nosotros didn't meet much persistent variation inward existent rates of interest, as well as what nosotros did meet was non correlated good with stock prices. Well, that was 1990, as well as right away is now. This graph suggests that inward fact a lot of the recent variation inward P/D corresponds to lower existent involvement rates. Also, it's the depression frequency, decade to decade displace inward P/D that is non good accounted for past times whatever models. An academic version of this observation needs to endure written.

Practical bottom line: The stories that the recent stock cost pass upward comes from rising long-term existent involvement rates brand sense. They powerfulness endure wrong, but they brand sense. That's proverb a lot to a greater extent than than most of the other stories existence bandied roughly right now.

Interest rates, growth, stock prices, as well as the Fed.

The story is non that like shooting fish in a barrel however. We take away hold to think most existent involvement rates \(r\) as well as growth \(g\) together. And at that topographic point is this puzzle to respond -- how tin it endure that expert tidings most the economic scheme sends the marketplace down? If \(P/D=1/(r-g)\) to a greater extent than \(g\) should heighten \(P\), no? It should shift upward the dashed line inward my foremost graph?

No. We take away hold to think most where existent involvement rates come upward from. One of the most basic relationships inward economic science is that higher growth way higher existent involvement rates. If everyone volition endure richer inward the time to come -- growth -- they ask an incentive to salvage as well as non blow it all today. And growth way a higher marginal production of capital, as well as thence higher involvement rates. As a unproblematic equation, \[ \text{real rate} = \gamma g \]where \(\gamma\) is a parameter, usually betwixt most 1/2 as well as 2, as well as larn ready for a bar care at the AEA convention over simply what value to use. 1% higher growth way most a one-half percent to ii percent higher existent involvement rate.

(There is a 2nd term too, of import inward agreement things similar the financial crisis. More doubtfulness way lower involvement rates. Not today.)

If \(\gamma=1\), if 1 percent growth way 1 percent higher existent involvement rates, as well as then higher growth has no outcome at all on stock prices or cost dividend ratios. (\(D/P = r^l + r^e - g.\) Raise \(r^l\) as well as \(g\) past times the same amount.) If, equally I think is to a greater extent than probable right inward this case, \(\gamma>1\), as well as then higher growth lowers stock prices. Yes. Higher growth way a higher discount charge per unit of measurement equally good equally to a greater extent than dividends. The discount charge per unit of measurement outcome tin overwhelm the cashflow effect.

This has cypher to practice with the Fed. There is a natural human vogue to facial expression for Agency, for some homo or adult woman behind the mantle pulling all the strings, as well as these days that way the Fed. For example, the WSJ Editorial on stocks:

"The paradox of the equity-market correction is that it’s taking identify fifty-fifty equally the existent economic scheme looks stronger than it’s been since at to the lowest degree 2005 as well as maybe 1999. "

"So why are stocks falling with all the expert news? The best respond we’ve heard is that stocks are reflecting a render to volatility as well as run a jeopardy afterwards years of the Fed’s financial repression. With its quantitative easing bond purchases, the Fed has for a decade suppressed marketplace cost signals inward bonds."

"Investors may finally endure figuring out that the global quantitative-easing monetary political party is ending."Look dorsum at my graph. Real involvement rates take away hold been on a irksome downward vogue since 1980. That vogue is unbroken since 2008. There is non a whiff that QE or anything else has budged that trend. (Lots of expert graphs on this indicate inward 8 heresies of monetary policy here. ) If the Fed has anything to practice with it, it is the irksome victory over inflation expectations, non QE as well as a lot of talk.

Yes, the papers similar to tell that higher growth volition receive the Fed to heighten rates. The Fed tin pose a finger inward this dike for a fleck if they desire to, but fifty-fifty the Fed cannot long care the positive or negative human relationship betwixt existent growth as well as existent involvement rates.

So it makes perfect sense, at to the lowest degree equally a logical possibility, that to a greater extent than growth lowers stock prices! Again, this is similar my lower line inward the foremost flick -- as well as truly a fleck improve because nosotros also heighten the terminal point. If this is what happened, well, regret that you lot didn't meet it happening as well as remain out during the dip, but endure reassured the marketplace volition arrive back.

Risk premiums

What most the ``unusually depression run a jeopardy premium''? Aren't the Fed's ``massive QE as well as abnormally depression involvement rates distorting run a jeopardy premiums as well as causing property cost bubbles?'' (The best Definition of ``bubble'' I tin muster is a run a jeopardy premium that is besides low, distorted somehow.)

Here is the opposite view. We are at the belatedly summertime of the concern cycle. The economic scheme is relatively healthy, at to the lowest degree if you're a stock marketplace investor. (Many of these ain companies.) Economic volatility is silent at an all fourth dimension low. Bonds are silent giving pretty atrocious existent returns. Yeah, stocks facial expression pretty healthily priced -- equally you lot contemplate your \(P/D = 1/(r^l + r^e - g)\) it looks similar the extra render from stocks \(r^e\) is pretty low. But what else are you lot going to practice with the money? You tin afford a piffling risk. Contrariwise, the same investors inward the bottom of the non bad recession, with rattling depression \( P/D\) signaling a high run a jeopardy premium \(r^e\), said to themselves or their brokers, yes, this is a buying opportunity, stocks volition probable bounce back. But my concern is inward danger of closing, my family powerfulness larn foreclosed, I simply can't accept whatever run a jeopardy right now.

In short, it is perfectly rational for investors to endure to a greater extent than risk-averse, as well as demand a higher run a jeopardy premium \(r^e\) inward the bottom of recessions, as well as to grip stocks despite a depression run a jeopardy premium inward placidity expert times similar right now. And this has cypher to practice with the Fed, QE, or anything else.

John Campbell as well as I wrote a unproblematic model of this phenomenon a long fourth dimension ago, as well as I've reviewed it several times since, most late here. Sorry for flogging the same ideas, but this possibility silent hasn't made it to, say, the Fed-obsessed WSJ editorial pages, to tell cypher of the Trump-obsessed pages at other outlets.

John as well as I tied run a jeopardy aversion to consumption trends. If consumption is high relative to the recent past, inward expert times, you lot to a greater extent than willing to grip risk. If consumption is declining relative to the recent past, you lot larn to a greater extent than scared. Lots of other mechanisms, including debt, move much the same way. If you lot don't similar the precise model, consumption relative to recent past times is a expert full general concern wheel indicator.

Let's facial expression historically. Here is consumption less a moving average (I used \(x_t = \sum_{j=0}^\infty 0.9^j c_{t-j})\), plotted with the log of the price/dividend ratio. The ii serial take away hold unlike scales. The indicate is to meet the correlation.

|

| Consumption minus a moving average, as well as log P/D on NYSE. |

The blueprint is longstanding. In expert times, when consumption rises relative to recent past, stock valuations move up. In bad times, such equally the non bad recession, consumption falls as well as so practice stock valuations. People are scared. The same blueprint happens regularly inward the past.

The ii lines drift apart, but equally nosotros saw to a higher identify existent involvement rates concern human relationship for that. Then the business-cycle related run a jeopardy premium hither accounts for the rises as well as dips.

And, if I may belabor the point, at that topographic point was no QE, null involvement rates, as well as so forth going on inward all these past times instances when nosotros meet exactly the same pattern. Higher existent involvement rates are a regular, simple, utterly normal business office of expansions, as well as lower run a jeopardy premiums are a regular, simple, utterly normal business office of expansions.

I was interested to read Tyler Cowen at Bloomberg back inward to this view, based only on intuition:

In a volatile as well as uncertain fourth dimension politically, nosotros take away hold observed sky-high prices for blue-chip U.S. equities. Other property prices also seem to endure remarkably high: habitation values as well as rentals inward many of the world’s top-tier cities, negative existent rates as well as sometimes negative nominal rates on the safest regime securities, as well as the formerly skyrocketing as well as silent quite high cost of Bitcoin as well as other crypto-assets.

Might all of those somewhat odd property prices endure business office of a mutual pattern? Consider that over the past times few decades at that topographic point has been a remarkable increase of wealth inward the world, most of all inward the emerging economies. Say you lot grip plenty wealth to invest: What are your options?

In relative terms, the high-quality, highly liquid blue-chip assets volition move expensive. So nosotros halt upward with particularly high price-to-earnings ratios as well as consistently negative existent yields on rubber regime securities. Those cost patterns don’t take away hold to endure bubbles. If this state of affairs persists, with a shortage of rubber investment opportunities, those prices tin remain high for a long time. They may move upward farther yet.

These high property prices practice reverberate a reality of wealth creation. They are broadly bullish at the global scale, but they don’t take away hold to demonstrate much if whatever expert tidings most those assets per se. Rather at that topographic point is an imbalance betwixt public wealth as well as rubber ways of transferring that wealth into the future

To amount this all upward inward a unmarried nerdy finance sentence, inward a public where wealth creation has outraced the development of expert institutions, the run a jeopardy premium may endure to a greater extent than of import than you lot think.

Except for this concern most "shortage of rubber assets," that's pretty much the intuition. (Tyler: all assets are inward fixed provide inward the small run. Prices adjust. This isn't truly a ``shortage.'') The indicate that high valuations extend to homes, bonds, bitcoins, as well as global stocks is a expert indicator that the phenomenon is generalized run a jeopardy aversion rather than something specific to 1 marketplace or economy.

This stance should non necessarily brand you lot slumber at nighttime however. It way that a downturn volition endure accompanied past times higher run a jeopardy aversion again, as well as non only volition dividends fall, prices volition autumn further. Moreover, historically, property cost falls take away hold been preceded past times periods of higher volatility. Alas, many periods of higher volatility take away hold simply faded away, so it's a alert sign non a signal. Sure, this mechanism way they volition bounce back, but if you lot are clairvoyant plenty to meet it coming it volition endure improve to avoid the fall! If not, well, endure read to purchase when everyone else is scared -- if you lot are 1 of the lucky few who tin afford non to endure scared.

The VIX, volatility, technical factors

There is some other form of ``discount factor variation,'' including 1987 as well as the flash crash. Sometimes the mechanism of markets gets inward the way, as well as prices autumn to a greater extent than than they should. They chop-chop bounce back. If you lot tin purchase at the bottom you lot tin brand a fortune, but the prices barbarous exactly because it's difficult to buy.

There were scattered study on Mon of hours long delays for retail customers to trade. (Can't let on link.) But I practice non larn a feel this was a large clog inward the markets. I would endure curious to listen from people closer to markets.

The bigger tidings is the render of volatility -- large daily changes. To pose this inward historical perspective, hither are ii plots

The surprise, really, is simply how depression low volatility had become. Historically the stock marketplace index has had a volatility roughly 15-20% per yr -- a typical yr saw a 15-20% change, as well as a typical twenty-four hr menstruation saw a \(15-20 / \sqrt{250} \approx \) 1 percent change. But, equally you lot meet inward the top graph, volatility also declines inward the belatedly summertime of the concern cycle. Volatility has many occasional piffling eruptions, typically roughly cost drops, as well as and then washes away. Except when volatility rises inward advance of the side past times side recession as well as marketplace decline. Which is this? I want I knew.

Volatility is non most "fear" nor is it most "uncertainty." Volatility occurs when options change quickly. Constant bad tidings or expert tidings simply leads to constantly depression or high prices. This is a sign of a fourth dimension when either a lot of existent information is hitting the market, or a lot of people are trying to procedure what's going on ahead of everyone else.

The "VIX bust" is hot inward the news. Influenza A virus subtype H5N1 lot of people bet that the graph you lot saw to a higher identify would non rise. To endure ``short volatility'' way basically that you lot write insurance to people who worry most markets going down, (volatility is a large business office of the value of pose options) as well as you lot write insurance to people who are worried most events similar right right away inward which markets start to displace a lot. Hello, when you lot write insurance, occasionally you lot take away hold to pay up.

As the graphs brand clear, writing volatility insurance, or betting that volatility volition move on to move down, is similar writing earthquake insurance. Not much happens for many years inward a row, as well as you lot tin post service prissy profits. Then it jumps as well as you lot lose large time. Anyone who did this based simply on historical returns is right away crying the tears of the greedy neophyte. But they take away hold lots of company. Back inward the 1990s, Long Term Capital Management went under, basically for betting that similar looking graphs would move on to move down.

Well, if afterwards all these years people are at it, P.T. Barnum had a expert give-and-take for them. But did this take away hold something to practice with the stock marketplace crash? How Bets Against Volatility Fed the Stock Market Rout inward WSJ is an representative of this prepare of thought.

On foremost glance, sure, a lot of people lost a ton of money, as well as and then sold out other risky positions. But Econ 101: for every buyer at that topographic point is a seller. Derivatives contracts are pure cases of this fact -- the cyberspace provide truly is zero, for everybody who lost a dollar shorting VIX somebody else made a dollar buying it.

To larn a story similar this to move you lot ask all sorts of marketplace discombobulations. Somehow the people who lost money must endure to a greater extent than of import to markets than the people who made money. This tin move on -- if a bunch of traders inward a complex obscure safety all lose money, as well as all travail to sell, at that topographic point is nobody to buy. But I don't truly meet that representative here, as well as stocks are non a complex obscure security.

Influenza A virus subtype H5N1 trader friend also tells me that he has seen lots of people halt hedging -- so sure depression volatility would move on that they don't comprehend the downside. He said many take away hold lost a ton, as well as right away are frantically selling to comprehend their positions. Such cost pressure level tin take away hold small run impacts, but does non in conclusion long.

Inflation as well as existent involvement rates

So we're dorsum at hints of higher long-term existent involvement rates equally the principal probable culprit behind this week's pass upward as well as gyrations.

Here besides most of the stories don't brand much sense. Inflation per se should non brand much difference. If expected inflation rises, involvement rates rise, but existent involvement rates are unaffected. Inflation may brand the Fed human activity to a greater extent than quickly, but at that topographic point is non much correlation betwixt what the Fed does with small term rates as well as the behaviour of 10 yr or to a greater extent than rates that thing to the stock marketplace -- or to corporate investment.

Yes, at that topographic point is some correlation -- particularly at the halt of expansions, small as well as long rates ascent together. But the correlation is a whole lot less than the usual Wizard of Oz behind the mantle stories. And fifty-fifty the Fed cannot displace existent rates for rattling long. There is a expert chicken-and-egg interrogation whether the Fed tin grip small rates downward for long when long rates desire to rise. The Fed pretty much has to restrain inward front end of the parade as well as pretend to Pb it.

Inflation does seem finally to endure rising. The fact that higher rates are associated with the dollar falling suggests that a lot of the higher rates are due to inflation, as well as TIPs take away hold non moved (top graph.)

So, the interrogation earlier us is, are long-term existent rates finally rising -- dorsum to something similar the historical norm that held for centuries, as well as if so why?

The expert story is that nosotros are entering a menstruation of higher growth. Depending on your partisan tastes, indicate to revenue enhancement cuts as well as deregulation, or state that Obama medicine is finally kicking in. This would heighten existent growth, with \(\gamma>1\) Pb to a pocket-size stock cost decline, but higher stock returns as well as bond returns going forward.

There is a bad story too. Having passed a revenue enhancement cutting that left untouched volition Pb to trillion-dollar deficits, Congressional leaders just agreed to $300 billion to a greater extent than spending. The Ryan excogitation that revenue enhancement cuts would endure followed past times entitlement reform may endure evaporating. Publicly held debt is $20 trillion. At some indicate bond markets tell no, as well as existent rates move upward because the run a jeopardy premium goes up. The United States of America of America is inward danger that higher involvement rates hateful higher involvement costs on that debt, which way higher deficits, which way higher involvement rates. $20 trillion times 5% involvement = $1 trillion inward involvement costs.

The one-time leads to some inflation if you lot believe inward the Phillips curve. The latter leads to stagflation inward a tight financial moment.

Which is it? I don't know, I'm an academic non a trader.

One consolation of the stock marketplace decline: I promise nosotros don't take away hold to listen how all the corporate revenue enhancement cutting did was to boost the stock market!

Well, ii days agone this was going to endure a small post service responding to the WSJ's stance that the Fed is behind it all, as well as Tyler's prissy intuition. It got a fleck out of hand, but I promise it's silent interesting.

****

Data Update (Geeks only).

P/D isn't truly "better" than P/E or other measures. Influenza A virus subtype H5N1 stair out is what it is, you lot take away hold to specify a interrogation earlier at that topographic point is an answer. Ideally, nosotros desire a stair out that isolates expected returns, as well as tells us if prices are higher or lower given the grade of expected dividends. So ideally, nosotros would concern human relationship for expected time to come dividends as well as the termination would endure a pure stair out of expected returns (rational or not). P/D industrial plant pretty good that way because dividends are non rattling forecastable. Price divided past times this year's dividends turns out to endure a decent approximation to cost divided past times anyone's forecast of time to come dividends. But non perfect. P/E is less expert that way because earnings bat most a fleck to a greater extent than than dividends. For private companies you lot can't purpose P/D, because so many of them practice non pay dividends. Following Fama as well as French, the ratio of marketplace value to volume value is improve there, because volume value is usually positive, or non so often zero.

I purpose the CRSP definitions. I start from the CRSP render with as well as without dividends as well as infer the dividend yield. ''Dividends" hither includes non only cash dividends but all cash payments to shareholders. So, if your pocket-size companionship gets bought past times Google, as well as the shareholders larn cash, that is a "dividend" payout. I suspect this accounts for the deviation noted by WC Varones below. As others indicate out, earnings has all sorts of mensuration issues, as well as also does non command for leverage.

Dividends are rattling seasonal, so you lot can't dissever cost past times this month's dividends or you lot larn a lot of noise. I purpose the in conclusion year's worth of dividends, brought frontwards past times reinvesting them. This introduces some "return" into the dividend series. If you lot simply amount dividends, though, identities similar \(R_{t+1} = (P_{t+1}+D_{t+1})/P_t \) no longer grip inward your annual data.

x = load('crsp_nyse_new_2018.txt');

caldt = x(:,1);

totval = x(:,2);

usdval = x(:,3);

sprtrn = x(:,4);

spindx = x(:,5);

vwretd = x(:,6);

vwretx = x(:,7);

[yr,mo,day,crsp_date_number] = decode_date(caldt);

T = size(vwretd,1);

vwretda = (1+vwretd(1:T-11)).*(1+vwretd(2:T-10)).*(1+vwretd(3:T-9)).*...

(1+vwretd(4:T-8)).*(1+vwretd(5:T-7)).*(1+vwretd(6:T-6)).*...

(1+vwretd(7:T-5)).*(1+vwretd(8:T-4)).*(1+vwretd(9:T-3)).*...

(1+vwretd(10:T-2)).*(1+vwretd(11:T-1)).*(1+vwretd(12:T));

vwretxa = (1+vwretx(1:T-11)).*(1+vwretx(2:T-10)).*(1+vwretx(3:T-9)).*...

(1+vwretx(4:T-8)).*(1+vwretx(5:T-7)).*(1+vwretx(6:T-6)).*...

(1+vwretx(7:T-5)).*(1+vwretx(8:T-4)).*(1+vwretx(9:T-3)).*...

(1+vwretx(10:T-2)).*(1+vwretx(11:T-1)).*(1+vwretx(12:T));

vwdp = vwretda./vwretxa-1; %D_t+1/P_t+1 = [(P_t+1+D_t+1)/P_t] / [P_t+1/P_t] -1;

vwdda = vwdp(13:end)./vwdp(1:end-12).*vwretxa(13:end); % D_t+1/D_t = D_t+1/P_t+1 / D_t/P_t * P_t+1/P_t

vwdda = [ones(23,1)*NaN; vwdda];

cumval = cumprod(1+vwretd);

vwdp = [ ones(11,1)*NaN; vwdp]; % maintain length of serial the same

I larn stock information from CRSP via WRDS. This is the NYSE only. I can't post service the total data, equally it belongs to CRSP. Here is an excerpt that volition allow you lot calculate the in conclusion year, as well as banking company check that things are right if you lot download the whole thing.

%crsp_nyse_new_2018.txt

% caldt totval usdval sprtrn spindx vwretd vwretx

19260130 27624240.80 27412916.20 0.022472 12.74 0.000561 -0.001395

19260227 26752064.10 27600952.10 -0.043956 12.18 -0.033046 -0.036587

19260331 25083173.40 26683758.10 -0.059113 11.46 -0.064002 -0.070021

19260430 25886743.80 24899755.60 0.022688 11.72 0.037019 0.034031

...

20160129 17059005700.00 17976992500.00 -0.050735 1940.24 -0.050111 -0.051700

20160229 16986848800.00 17001893900.00 -0.004128 1932.23 0.005104 0.002251

20160331 18122913200.00 16951468600.00 0.065991 2059.74 0.072190 0.069562

20160429 18503144900.00 18082712100.00 0.002699 2065.30 0.023324 0.021716

20160531 18479138100.00 18410229900.00 0.015329 2096.96 0.006124 0.003392

20160630 18613173100.00 18422135300.00 0.000906 2098.86 0.011175 0.008957

20160729 19054705700.00 18557630600.00 0.035610 2173.60 0.028433 0.026872

20160831 18993464300.00 19049575300.00 -0.001219 2170.95 0.000196 -0.002532

20160930 18829544800.00 18880924600.00 -0.001234 2168.27 -0.003876 -0.005878

20161031 18404742600.00 18802632900.00 -0.019426 2126.15 -0.021331 -0.022944

20161130 19220882900.00 18383296300.00 0.034174 2198.81 0.048548 0.045701

20161230 19568491300.00 19178151000.00 0.018201 2238.83 0.021566 0.019486

20170131 19824534000.00 19526674900.00 0.017884 2278.87 0.014007 0.012623

20170228 20355248600.00 19781803200.00 0.037198 2363.64 0.031422 0.028905

20170331 20237616500.00 20334429600.00 -0.000389 2362.72 -0.003961 -0.006103

20170428 20286715000.00 20194157100.00 0.009091 2384.20 0.003950 0.002468

20170531 20299003900.00 20276905500.00 0.011576 2411.80 0.002199 -0.000507

20170630 20602218600.00 20256933000.00 0.004814 2423.41 0.018204 0.016235

20170731 20747539100.00 20488018000.00 0.019349 2470.30 0.015290 0.013394

20170831 20593088100.00 20742392900.00 0.000546 2471.65 -0.005133 -0.007874

20170929 21147810200.00 20381001300.00 0.019303 2519.36 0.030435 0.028662

20171031 21343546700.00 21130998500.00 0.022188 2575.26 0.011831 0.010360

20171130 21904734200.00 21302790800.00 0.028083 2647.58 0.030537 0.027670

20171229 22016063100.00 21683038400.00 0.009832 2673.61 0.015914 0.014117

If I screwed up, allow me know as well as I'll ready it!

0 Response to "Stock Gyrations"

Posting Komentar